"We Overpaid For Years": Frugal People Are Sharing Their Best Money-Saving Habits

I love saving money, but sometimes, the things people swear will save you some cash can be so time-consuming that I wonder how anyone finds the time. So when I came across this Reddit thread of frugal people sharing their easiest money-saving habits, I was all over it like a cat on a brand-new box. Here are some of the top comments:

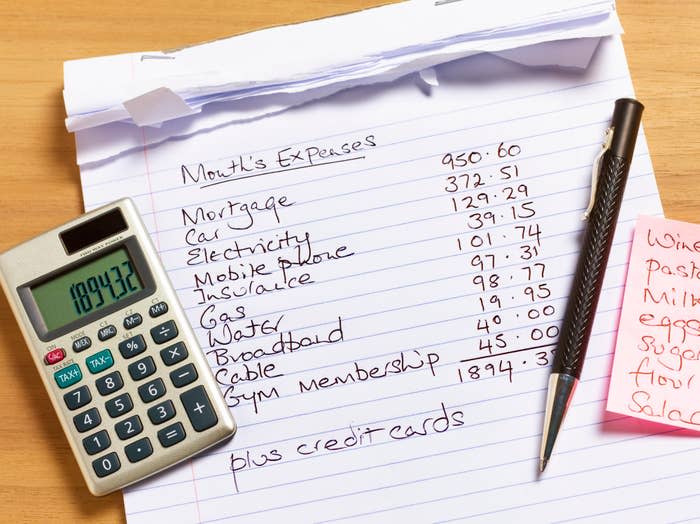

1."Writing down every expense in an actual budgeting notebook. I've tried budgeting apps on and off for years and never stuck with them. Having an actual notebook where I physically write all of my expenditures has made me way more frugal in every aspect of my life. Something about writing it and seeing it made me want to stop spending it!"

"Carrying cash helps too. Parting with a paper $20 is harder than swiping a card for me."

2."Put things in the Amazon cart, but don't buy right away. Come back a few days later and realize I don't NEED that, remove. Repeat."

"I make it even more simple and just write down whatever I'm wanting to buy on the Notes app on my phone. Somehow, it reduces pressure, and most times, I'll just forget it unless it's something I actually need."

3."Started shopping at the discount grocery store. Ours has lots of things that are nearing or just past sell-by dates, and I was nervous things might not be good. Haven't had a single issue, and we're literally saving hundreds per month on groceries."

4."Finally got a library card and connected to my Kindle via Libby. I haven't bought a single book, ebook or physical, all year."

"I do audiobooks through Libby, and it’s great! I’m 'reading' a lot more now."

5."Use the envelope method for groceries and my fun money. It makes me pay attention to how much money I'm spending and what I'm spending it on when I have to count out the cash."

6."Buy powdered drink mix for my sports-playing kids instead of bottled sports drinks after every practice."

"Walmart sells a BIG (and small) size of Gatorade drink mix. I used to buy it for working at a camp all summer. One BIG one would last all summer and then some. Saves time and money!"

7."One morning, when I had some downtime, I went through my email and unsubscribed from basically any email list I was a part of. All of it. Not only has this completely cleared up my inbox, but I no longer get tempted by sale days, coupon codes, etc. It has helped curb impulse spending immensely!"

"I subscribe when I’m waiting for a sale and then immediately unsubscribe once I bought what I had been eying.

For places I shop at more frequently, I have Gmail filter out the promo emails and send them directly to my trash. Then, when find I need something from one of my subscribed stores, I search my trash for a sale or coupon. That way, I’m completely in control; it happens on my terms. Plus, the trash clears itself every 30 days, so I won’t be bothered by old promotions!"

8."I switched my savings from my account I've had literally forever to a high yield savings (4% apy or something). It's not an account I can easily withdraw from, so that money is sitting safe. I went from getting like a single cent from my money every month to $30 or so."

9."Cancelled cable. No one was watching ‘regular’ TV. We kept Prime and Hulu. No one in the house has noticed."

10."Stopped using DoorDash and started using frozen chicken strips and tater tots when I need a quick fix."

11."I have started to go through all drawers, cabinets, wardrobes, etc, having a clear out. Not only have I discovered things I'd forgotten and organized things in such a way that I know how much of everything I have, but it's illustrated to me where I was making impulse purchases that I regretted. That's helped me stop repeating those same mistakes. For example, I am done with eyeshadow, I've never really 'got' how to do it, I end up looking awful, and I've chucked the lot out; it wasn't a matter of finding the 'right palette,' it's just not for me!"

12."Switching auto and home insurance. Our auto went down by two-thirds and our home by half. I don’t even want to think of the money we overpaid over the years."

"My husband is a retired insurance exec and has always comparison shopped auto and home insurance. It has saved us every year.

Choose a well-known insurance company that will pay your claims quickly, and that has a good customer service reputation.

If you choose to bundle and they don't price match the other competitors, tell them you are looking for the best value."

13."Removed my saved credit card info from every online store. It’s safer, but also, my want for an item goes down significantly if I have to get off the couch to grab my wallet."

14."Getting rid of paper towels at home. I bought a thing of painter's rags for my art space and brought most of them into the kitchen. They go in a bag to use and into the laundry to wash."

15."Meal Prep! I prep five oatmeal breakfasts, five chicken pasta and sauce meals, and five chicken, rice, and black bean meals. This saves me so much money and time! I mix in fruit cups for breakfast and lunch. I usually go with pineapple or mandarin oranges. I eat way healthier, and I’m saving money."

16."Fewer trips to the grocery store! After routinely popping in three or four times per week for odds and ends forgotten on my primary weekend trip, I started going to the grocery store just once a week. This restricts opportunities for unhealthy impulse purchases, pressures me to use and consume the fresh food and pantry items I already have on hand instead of letting them go to waste, and sometimes saves on fuel for short, inefficient car trips to the neighborhood grocer (if I'm desperate, I make myself ride my bike). The main grocery store chain in my area offers a weekly coupon for four times fuel points on Fridays. By restricting most grocery purchases to Fridays, I can also optimize that perk, which is a great bonus."

"We also only go once a week. I refuse to go in between my weekend shops, and it definitely forces us to use what we have at home. Can’t walk out of the grocery store for less than $100 it seems, even if you just pop in for a few things. So we improvise, and we get creative, and we change it up when we run out of something. It’s great — plus, it means that I save time by only going there once, and that makes everyone happy."

17."I often met up with friends at restaurants, just by default, and that got really expensive, even when they weren't that special. I started volunteering ideas of just meeting for dessert (instead of a drink and meal), going for a hike, or just meeting at a park to sit and chat. The whole point was to just be together, so no one really paid attention to the switch, and they were actually a little glad not to have to plan the outings themselves. My budget is happy about it!"

18."Went back to doing my own manicures. I have such a collection of polish to use up!"

"I just want to warn that it's very easy to develop a gel allergy when doing your own nails. I almost lost all my fingernails trying to be thrifty. It was awful. Acrylics and dip powders have way smaller allergy chances and are also super frugal to do yourself."

19."Starting to cook my own meals more and not eating in restaurants. Every time you cook a meal, you make it better. I’m at the point now where food served in restaurants isn’t good enough for me. Go YouTube!"

20."Finance hack here. If I need a big power tool for something, I buy it on Facebook Marketplace, use it, and then resell it on Facebook Marketplace. Usually, it’s for the same price, but sometimes I get more. For example, my kids wanted an in-ground basketball hoop. I bought an auger for $100, used it, and sold it for $160. I bought a concrete mixer for $150, used it, and sold it for $175. For another project, I bought a table saw for $100, used it, and sold it for $100."

21.And finally, "Went on a 'no-buy.' Sounds nuts, but gamifying making do with my existing wardrobe, decor, cooking utensils, gardening tools, etc, has made it so easy. And it simplifies the process of figuring out whether a purchase is worth the money because it DOESN'T MATTER — I'm not allowed to buy it anyway. I did a no buy month and wondered if I would make it through but wound up breezing through it and found it so helpful and easy that I am committing to a year."

Do you have any easy money-saving habits? Share what works for you in the comments!

Yahoo Lifestyle

Yahoo Lifestyle