Why We Like eGain Corporation’s (NASDAQ:EGAN) 17% Return On Capital Employed

Today we'll look at eGain Corporation (NASDAQ:EGAN) and reflect on its potential as an investment. To be precise, we'll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

First of all, we'll work out how to calculate ROCE. Next, we'll compare it to others in its industry. Last but not least, we'll look at what impact its current liabilities have on its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Generally speaking a higher ROCE is better. Overall, it is a valuable metric that has its flaws. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that 'one dollar invested in the company generates value of more than one dollar'.

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for eGain:

0.17 = US$5.9m ÷ (US$80m - US$45m) (Based on the trailing twelve months to September 2019.)

Therefore, eGain has an ROCE of 17%.

View our latest analysis for eGain

Is eGain's ROCE Good?

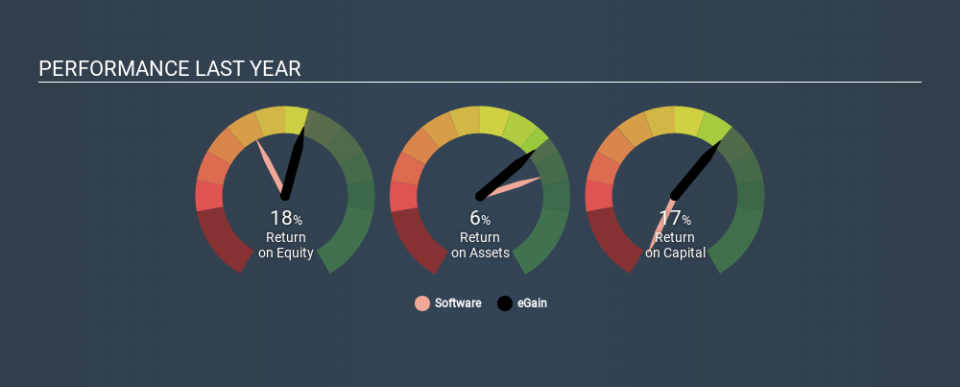

ROCE is commonly used for comparing the performance of similar businesses. In our analysis, eGain's ROCE is meaningfully higher than the 9.8% average in the Software industry. We would consider this a positive, as it suggests it is using capital more effectively than other similar companies. Independently of how eGain compares to its industry, its ROCE in absolute terms appears decent, and the company may be worthy of closer investigation.

eGain delivered an ROCE of 17%, which is better than 3 years ago, as was making losses back then. This makes us wonder if the company is improving. You can see in the image below how eGain's ROCE compares to its industry. Click to see more on past growth.

When considering ROCE, bear in mind that it reflects the past and does not necessarily predict the future. ROCE can be misleading for companies in cyclical industries, with returns looking impressive during the boom times, but very weak during the busts. ROCE is only a point-in-time measure. Future performance is what matters, and you can see analyst predictions in our free report on analyst forecasts for the company.

How eGain's Current Liabilities Impact Its ROCE

Liabilities, such as supplier bills and bank overdrafts, are referred to as current liabilities if they need to be paid within 12 months. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To counteract this, we check if a company has high current liabilities, relative to its total assets.

eGain has total liabilities of US$45m and total assets of US$80m. Therefore its current liabilities are equivalent to approximately 56% of its total assets. eGain has a relatively high level of current liabilities, boosting its ROCE meaningfully.

Our Take On eGain's ROCE

While its ROCE looks decent, it wouldn't look so good if it reduced current liabilities. There might be better investments than eGain out there, but you will have to work hard to find them . These promising businesses with rapidly growing earnings might be right up your alley.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Lifestyle

Yahoo Lifestyle