What Happens to John Amos’ Estate After Elder Abuse Claims? Legal Experts Explain (Exclusive)

“It is clearly unusual not to let anyone know, and whether directly or indirectly, that John had passed away,” attorney Jonathan Forster tells PEOPLE regarding John Amos' death

Shahar Azran/WireImage/Getty

John Amos attends the 2014 Doe Fund Benefit & Gala at Cipriani 42nd Street in New York City on October 30, 2014.Following the shocking news of John Amos’ death in August, questions have risen about what happens to his estate given the challenging circumstances surrounding his children.

At the time of his death, John’s son, Kelly Christopher (K.C.) Amos was taking care of him. His daughter, Shannon Amos, who had accused her brother of elder abuse, was estranged from the family with a no-contact order against K.C.

With this complicated dynamic and John’s past claims that Shannon was actually committing the elder abuse against him, it is unclear how his estate will be handled.

In an exclusive interview with PEOPLE, estate and probate attorneys Jonathan Forster from Weinstock Manion and Marc M. Stern from Greenberg Glusker are breaking down the details of what might go down legally in the coming months.

Related: A Full Timeline of John Amos' Family Drama

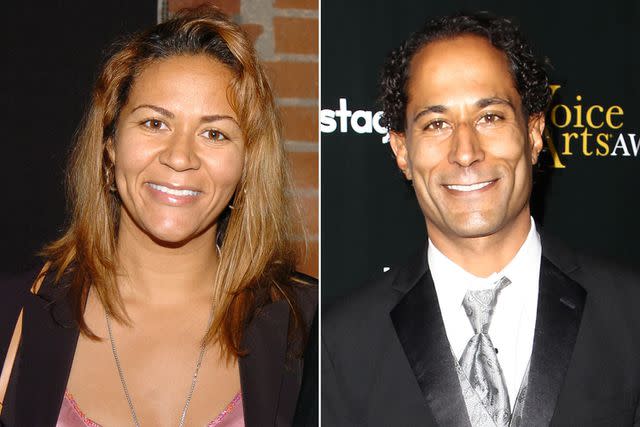

Brian To/FilmMagic

John Amos, Shannon Amos, and K.C. Amos at the 1st Annual "A Celebration of Heroes" Power Heroes Gala on December 3, 2008 in Los Angeles, California.John likely had a trust

When it comes to having a will versus a trust, Forster and Stern both say it is most common for celebrities to have a trust. This is because a trust remains private while a will’s validity has to be proven through probate in the court system since there is no fiduciary of a will.

“When you when you die without a trust, you have to go through probate, and probate is a court-supervised transfer of assets, and that's a public administration,” Forster explains. “So most celebrities do not want their estate to go through probate for privacy concerns, and if they have a trust, then the trustee named in their trust would be responsible for all of that.”

A fiduciary, or trustee, Stern tells PEOPLE, is the person assigned to distribute the contents of a trust and is separate from the trust’s beneficiaries. “It may be Bank of America or Wells Fargo Bank, or it may be my brother or my father or something else,” Stern says.

If John’s beneficiaries were K.C. and Shannon, then they would not necessarily have to communicate with one another in the distribution of their father’s estate, but Forster says things could get more complicated if one or both of the children are named as fiduciaries.

“If they were serving together as trustees and they have a no-contact order, they would have to figure out how to manage this situation,” Forster says.

J.Sciulli/WireImage

Shannon and K.C. AmosCan Shannon and K.C. break their no-contact order?

Shannon received a no-contact order against brother K.C. following what she alleged were threats directed at her in 2023. At the time of John’s death, the order was still active (K.C. is currently on pretrial release) and the two are not allowed to have any communication.

The question, Stern says, is, who is the executor of the trust? The conflict between having “a duty” for a trustee to contact a beneficiary and the court-issued no-contact order could become a potential issue between the siblings, the attorney adds.

“[It’s] most likely one of those two, maybe both of them together," Stern says. "It's not uncommon for someone to say both of my children together, or all of my children together, are trustees or executors. So it's altogether possible but it's not a certainty.”

“He could have named his business manager as the executor, and then the business manager would need to divide things up, and the two beneficiaries would not necessarily need to talk together,” he continues.

If one or both of his kids are his trustees and beneficiaries, then Stern explains that they will need to go through a legal process to put terms in place regarding their communication about the trust. If, for example, K.C. is the fiduciary, he would need to have an attorney mediating or make changes to the order.

“He [could] again go to court and say, ‘Look, I need to be able to talk to the beneficiary. What do I do here? Give me instructions so that I'm not violating the other order,’” Stern says.

Never miss a story — sign up for PEOPLE's free daily newsletter to stay up-to-date on the best of what PEOPLE has to offer, from celebrity news to compelling human interest stories.

When it comes to payments and income postmortem, such as residuals from John’s past projects, Forster says John likely has a designated trustee to distribute and handle the money.

“They could just say, all of my assets go to my children, and the children would equally share the residuals and the management of those property rights,” Forster says, adding that in that case, as long as K.C. or Shannon is not that assigned trustee, there would be no need for contact between the two.

Another problem with the no-contact order that is less likely to arise is if one of the children wants to “bring an action against” John’s estate. This could happen for various reasons, such as one being written out of the trust or not inheriting an equal share of it, Forster explains.

“If [Shannon’s] going to bring an action against her father's estate [hypothetically], presumably she's going to do that through her attorneys, as opposed to she herself contacting her brother,” he says. “So I don't know that that, in and of itself, is going to become an issue.”

J.Sciulli/WireImage

John Amos and daughter Shannon during Cure Autism Now Celebrates Third Annual "Acts of Love" - After Party.Can Shannon or K.C. dispute the trust after John's death?

Shannon and K.C. both have the right to dispute John’s trust after his death, Forster says, but that requires good reason to do so. Given the past legal conflict and estrangement between John and daughter Shannon, it is possible John changed her role in his trust before he died.

“In general, people leave their assets to their children, and they don't cut out a child unless there's good reason to do so,” Forster says. “But if the disinherited child wanted to bring an action against the estate, it would typically be for one of two reasons: One is the person lacked capacity when they signed their estate plan documents. So for example, they were suffering from dementia, they didn't know what they were signing. Their child took them to a lawyer and had them sign documents when they truly didn't understand. That would be one reason.”

“Another reason would be undue influence,” he continues. “So if, if one of the kids was unduly influencing John. For example, if K.C. was unduly influencing John to write out his sister and John could not resist that influence, that would be another reason.”

Stern adds that it is common at his practice for there to be objections to a trust after the death of the grantor.

“One of the things that keeps me in business is that children go in, one child goes in, and gets the parent, frequently in a weakened state at the end or late stages of their lives — not always, but most often — to change their estate plan and to give more to the one party and not to the other. In this case there would be grounds for a will or trust challenge by either the disinherited or disfavored child, otherwise it is uncommon."

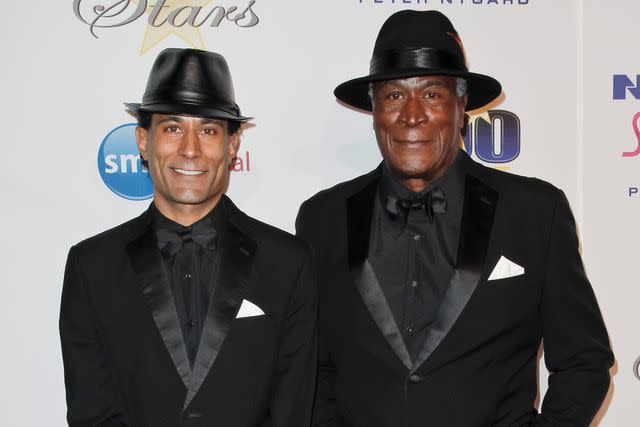

Tibrina Hobson/WireImage

K.C. and John AmosHow can past elder abuse claims impact the estate?

Shannon accused K.C. of “elder abuse and financial exploitation” in an Instagram post in June of 2023. She claimed her brother removed John from the medical care he needed and later transferred him out of the facility he had been living in. She also shared a link to a GoFundMe looking to raise $500,000 for him.

John later spoke out against these allegations, calling for the GoFundMe to be taken down and stating that Shannon was the one committing elder abuse against him, although details of what that abuse consisted of are not entirely clear.

“Elder abuse can take the form of financial elder abuse, where you're stealing from the person's assets,” Forster explains. “Whether you're trying to use some of their assets for your own personal gain, whatever that may be. Or it could be elder abuse relating to his care and it sounds like the daughter was accusing the son of not providing [John] with the best care in and of itself.”

Shannon’s specific accusation is telling of what could potentially come in the future with disputes over John’s estate, Stern says.

“For example, if the daughter is accusing the son of stealing from dad, she may bring actions in connection with the distribution of his estate that the son was diverting assets, or using assets for his own purpose, or stealing from him, or whatever it may be,” Stern says. “It is entirely possible that [based on] these actions, that this is being set up to challenge some aspect of the estate.”

Jim Spellman/WireImage

John AmosWhy did K.C. delay announcing John's death?

At the time of John’s death — which was due to natural causes from congestive heart failure, per his death certificate — he was not speaking with his daughter Shannon. When K.C. announced Oct. 1 that John had died over a month earlier on Aug. 21, John’s goddaughter Amy Goudy and Shannon claimed they learned the news from the media.

“It is with profound sadness and distress that we must share the circumstances surrounding our father’s passing,” they wrote in a joint statement on Facebook on Oct. 2. “He was a loving man who brought light into the lives of many. However, our family only learned of his death today through media reports, only to discover he actually passed away 45 days ago. Shockingly, we were not notified, nor were any family members informed. This tragic news has left us in shock and heartache. We do not have a death certificate, nor do we know where or why he died, but we know he was suffering from congestive heart failure and dementia. We fear he was likely cremated to avoid any potential investigation into the conditions surrounding his final days.”

This speculation about John’s health sparked concern, but John’s longtime publicist Belinda Foster claimed K.C. didn’t tell Shannon due to the no-contact order and maintained John was well taken care of.

"Shannon's claims that John was abused are false," Foster continued. "K.C., Eugene and I, along with numerous others, cared for him. On several occasions when Shannon claimed that he was abused, law enforcement authorities sat with John and confirmed his well being."

Forster explains that there are several reasons for John’s death to remain private for so long.

“It is clearly unusual not to let anyone know, and whether directly or indirectly, that John had passed away,” Forster says. “It is absolutely unusual, and it could be done for a variety of reasons. One could be he was not ready for the next step in terms of dealing with his sister and dealing with his family, or it could be a more nefarious cause that he was trying to take advantage or take control of. The situation and his father's assets. It's really hard, it's hard to say, but that is unusual.”

For more People news, make sure to sign up for our newsletter!

Read the original article on People.

Yahoo Lifestyle

Yahoo Lifestyle