Apple Card may get people to finally use Apple Pay

Apple (AAPL) CEO Tim Cook revealed on Tuesday that it’s rolling out the Apple Card in August, and it might finally get more people to use Apple Pay.

Apple Pay was announced all the way back at the iPhone 6 event in September 2014. At the time, Cook bashed the lax security of the plastic credit card and unveiled the phone-based tap-to-pay payment service.

In the nearly five years since, only a small proportion of people have used the service at the cash register, despite the advantages of the system and ubiquity of contactless NFC terminals.

But Apple’s new venture into the world of credit cards has the potential to change the American payment landscape significantly and give a long awaited boost to tap-your-phone to pay payments, or “proximity mobile-based payments.”

“Apple and [Goldman Sachs] represent strong brands and many merchants can now accept Apple Pay due to EMV point of sale terminal upgrades,” Wells Fargo Securities analysts wrote in a note. “This card will likely increase use of Apple Pay.”

The news that Apple Cards would roll out in August came during its third-quarter earnings call on Tuesday. The tech giant beat analysts’ expectations on both the top and bottom lines, and its stock reached 2019 highs after the announcement.

Apple Pay just isn’t that popular

Adoption of Apple Pay has been far behind what Apple and many others had hoped as the American — and to some extent, worldwide — preference for plastic (and metal) cards has been hard to change. According to an eMarketer report from December, only 27.4% of U.S. smartphone users said they had used contactless payments at least once in the past six months. In terms of the population, this is about 61.6 million in 2019 — a lot, but far less than the 7 out of 10 Americans with at least one credit card, not to mention debit cards.

Even companies like Paypal’s (PYPL) Venmo, which is a digital-first payment provider, stepped backwards in time to launch a plastic card, because of some resistance to mobile payments at the checkout counter.

Apple is not a magical, failure-proof company, but it does have an almost singular ability to make things catch on that otherwise are unpopular or undesired. In recent years, the company pushed the Apple Watch through to a respectable level of success, forced people to accept the headphone jack’s demise, and turned the AirPod from a Q-tip joke to a popular product.

Though the company failed to fundamentally change the payments industry, its second attempt has some things behind it that could make a difference.

A premium product within reach

On a fundamental level, Apple is releasing a hardware product with it, for the first time, which makes a difference. The physical card is pretty and very Apple-y, made of laser-etched titanium and sure to make an ostentatious noise when dropped. It’s something people are likely to covet given the Chase Sapphire Reserve’s hubbub when it ran out of metal and had to give people plastic. (Let’s not forget the Fyre Festival perpetrator Billy McFarland made a company almost chiefly on the premise of a metal payments card, something that is already inviting comparisons.)

A premium credit card — in appearance, at least — should be within the reach of millions of Americans. Apple has not released an exact credit score you need to obtain the card, but according to Ted Rossman of CreditCards.com, it’s likely to be “relatively easy to get.”

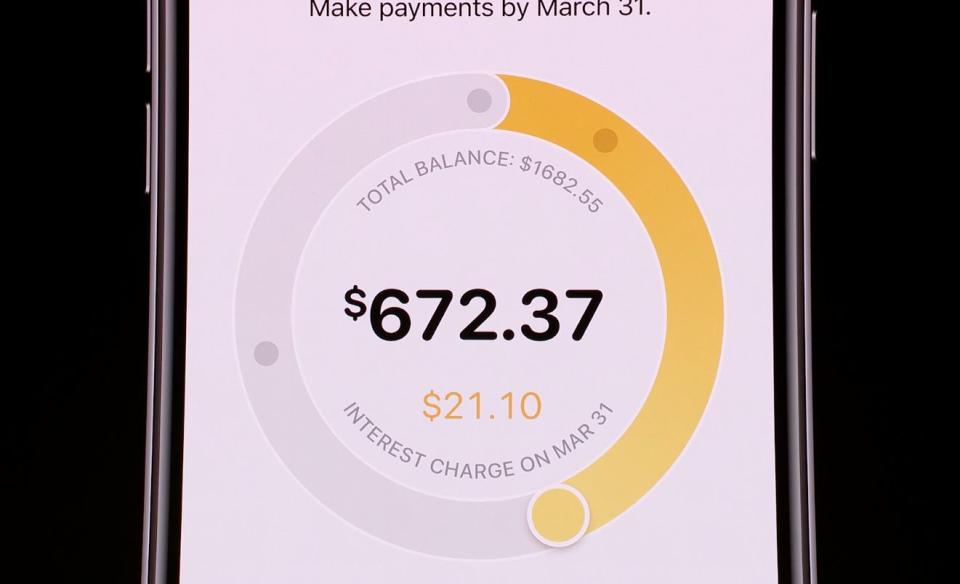

The variable annual percentage rate for the card falls between 13.24% and 24.24% depending on credit score, Apple has said. Rossman has estimated that the highest credit tier of around 740+ could get a little over 13% APR and 24.24%, the highest end, “should be attainable for people in the fair/subprime space.” This puts a potential barrier to entry to those with credit scores in the mid-600s. For this cohort especially, Apple’s lack of late fees and penalties, spend tracking, low interest rates, and ability to potentially manage interest payments a little better are all useful.

Another perk that will push users to pay with their iPhones: 2% cash back on purchases (it’s 1% if they pay with the card).

This nudge to mobile will be amplified by the fact that it’s called “Daily Cash,” designed to put the user’s attention on the cash they’re getting back. Seeing the cash back on a regular basis will likely promote further mobile contactless payment use.

Apple Pay adoption might start in the middle of the credit scale

The 2% cash back rewards that has “underwhelmed” credit card experts and lack of a sign-up bonus means that Apple may not get the business from people with terrific credit, many of whom chase ultra-generous rewards from JPMorgan’s (JPM) Chase Sapphire Reserve and American Express’s (AXP) Platinum cards. (Though, of course, they may also choose to get an Apple Card and not use it.)

What this means is that it may be the middle of the credit score market that makes the biggest progress in advancing contactless mobile payments, not Apple’s typically higher-end market.

Rossman says that Apple is a big part of this, but that Apple’s move comes at a time when many contactless payments systems are converging. And one venture’s rising tide may lift all boats.

Right now, Chase, Visa, Capital One, and more are all in the process of rolling out contactless cards in greater numbers, Rossman said. At the same time, public transit systems — as Apple noted — in New York, Chicago, and Portland are transitioning to RFID technology, which is how Apple Pay works.

As both Rossman and Wells Fargo research have noted, all these other tap-to-pay contactless players — which will use a physical, tappable credit card, not an iPhone — may be headwinds to Apple Card’s growth, especially given that the timetable is the same. Though Apple has the benefit of a big launch and news articles to spread the word, people with Chase, Capital One, and other credit cards will find out by simply getting a new card in the mail.

This story was originally published on March 27, 2019.

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Yahoo Lifestyle

Yahoo Lifestyle