Threat of TikTok Ban Can’t Stop Its U.S. Retail Ambitions

A lot of tech platforms court brands at retail conventions with splashy shopping updates, but few might do that right after lawmakers threaten to ban them. That, however, is the awkward position that TikTok found itself in this week at a retail conference in Las Vegas.

The company took to the Shoptalk floor to talk up TikTok Shop and promote its latest updates, which include new ad formats and placements. Along the way, it surely hoped to downplay the existential threat it faces.

More from WWD

But it’s hard to escape the fact that the major draw for brands and retailers comes from its massive appeal to GenZ and others in the U.S., which now could be upended. Last week the House of Representatives passed a bill calling for the business to change hands to an American owner or see its connection to U.S.-based users get severed.

Since the news broke, TikTok has been having private conversations with advertisers, while it attempts to negotiate with a government that views its link to Chinese parent company ByteDance as a national security threat.

The precise nature of the conversations is unclear, as TikTok declined to discuss the matter. But it insisted that — as representatives milled about a retail convention of more than 10,000 attendees, including brands, would-be advertisers, and more than 900 technology platforms and solution providers — the topic didn’t really come up much.

“I think people are not focusing on that at all, because most of the advertisers, I do believe, are very much focusing on the business itself,” Ray Cao, global head of TikTok’s Monetization Product Solutions and Operations, told WWD.

“I do believe that [there] is actually a lot of confidence in us in the market right now,” he said. More so than at any other time in the five or so years that Cao has worked for TikTok, he believes that “this actually is a pretty good time for us to keep focusing on the business and charging forward.”

On that front, there’s plenty to focus on.

By any measure, TikTok qualifies as a cultural phenomenon that’s fast approaching 150 million monthly users in the U.S. and 7 billion views of #TikTokMadeMeBuyIt posts. It intends to channel all that popularity into a booming shopping destination. “The vision for TikTok is always trying to empower commerce on this platform everywhere,” said Cao, “so this is where we want to go. Because we’re already seeing our users really demand that kind of behavior.”

Enter TikTok Shop. Its goal, according to Bloomberg, is to pull in as much as $17.5 billion in U.S. gross merchandise value this year. If it pulls that off, it would multiply its 2023 GMV 10 times over.

The social commerce offering launched last September after years of testing. So even though it has been around long enough to build plenty of buzz, it is still a nascent offering. For instance, it may seem strange that a teeming social video network would only recently introduce video shopping ads to the world. Then again, creating fun features to capture dance crazes is different than releasing business tools.

According to TikTok, it built out an ecosystem of tech and e-commerce partners, such as Shopify, to simplify onboarding. Thanks to new data connections and pre-populated campaign settings, TikTok’s Shopify app allows merchants to create and launch video shopping ads in a matter of a few clicks.

“Big-box advertisers have a massive amount of catalogues, so we also empower a catalogue and carousel format, to really get them easy access to these formats and make sure they can demonstrate the variety of [their] products,” said Cao, adding that TikTok consulted particularly with apparel brands, as fashion is a key area for the company.

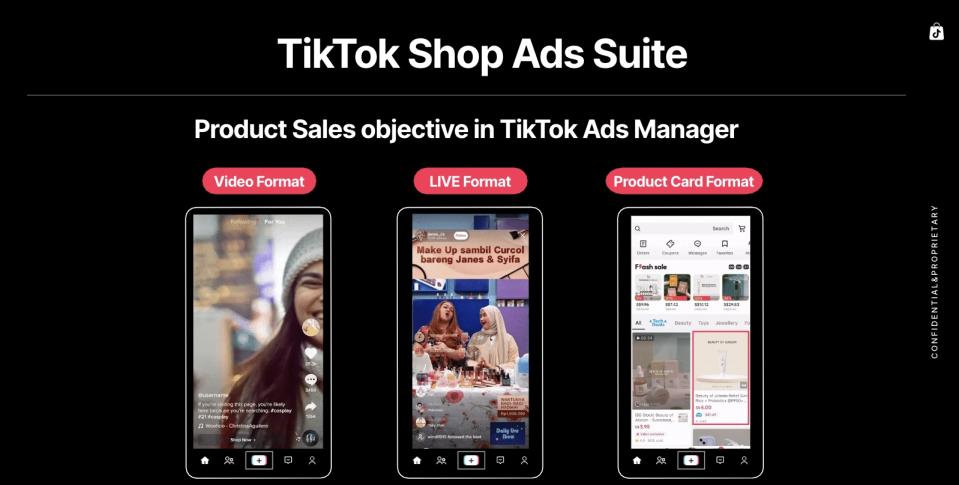

Within its own app, TikTok also extended the placement of Shop Ads, so brands can highlight products and sell directly in the new TikTok Shop tab using an image from their existing product catalogs. The ads manager dashboard now supports video, live and product card formats.

TikTok’s focus, according to Cao, is on removing barriers and irritations for merchants so they can have “the best experiences on TikTok, rather than having to spend a lot of time learning how to use TikTok.” But this is a process, he added, so developers and engineers will continue to polish for the rest of the year.

The effort won’t end there. The company is deeply interested in new technologies, like Apple’s Vision Pro. TikTok was among the early developers to launch an app for the mixed-reality headset, so users can watch videos in a virtual Yosemite or moonscape, for instance. TikTok Shop isn’t available there yet, but Cao finds this and other prospects intriguing.

Whether Shop will be able to get there one day hinges on the U.S. Senate. If the bill passes there, President Joe Biden stated that he’d sign it. That would be a five-alarm fire for TikTok — especially after user growth reportedly stumbled for the very first time following the House vote, so say sources who spoke to The Wall Street Journal.

TikTok may be trying to downplay the situation with business partners, but its alarm is evident in an official statement describing the bill as an “outright ban of TikTok, no matter how much the authors try to disguise it.” It goes on to say that “the legislation will trample the First Amendment rights of 170 million Americans and deprive 5 million small businesses of a platform they rely on to grow and create jobs.”

What will happen next is tough to predict. As in other matters, political discourse around the app is fractured, so TikTok’s fate isn’t sealed yet.

At least some people are taking the uncertainty in stride — like Amber Venz Box, cofounder and president of creator-driven shopping platform LTK, formerly RewardStyle and LikeToKnow.It.

“Last year the average U.S. adult user spent 53.8 minutes daily on TikTok alone. If TikTok were to be banned, you would just see a lift and shift of that discretionary time into another social media platform that would fill that entertainment gap,” Venz Box told WWD. “Like creators and consumers, brands will evolve too.

“Brands are no longer taking a platform-specific approach,” she added. “[This] is just another example of why creators can’t rely on just one platform to build and grow their businesses or engage their communities.”

Best of WWD

Yahoo Lifestyle

Yahoo Lifestyle