Democratic senator to Powell: Get moving on faster payments

Sen. Chris Van Hollen (D-MD) has a message for the Fed: Get going on a faster payment system now.

“They need to get on the ball and get moving because every day they delay is more money out of the pockets of American consumers,” said Van Hollen in an interview with Yahoo Finance.

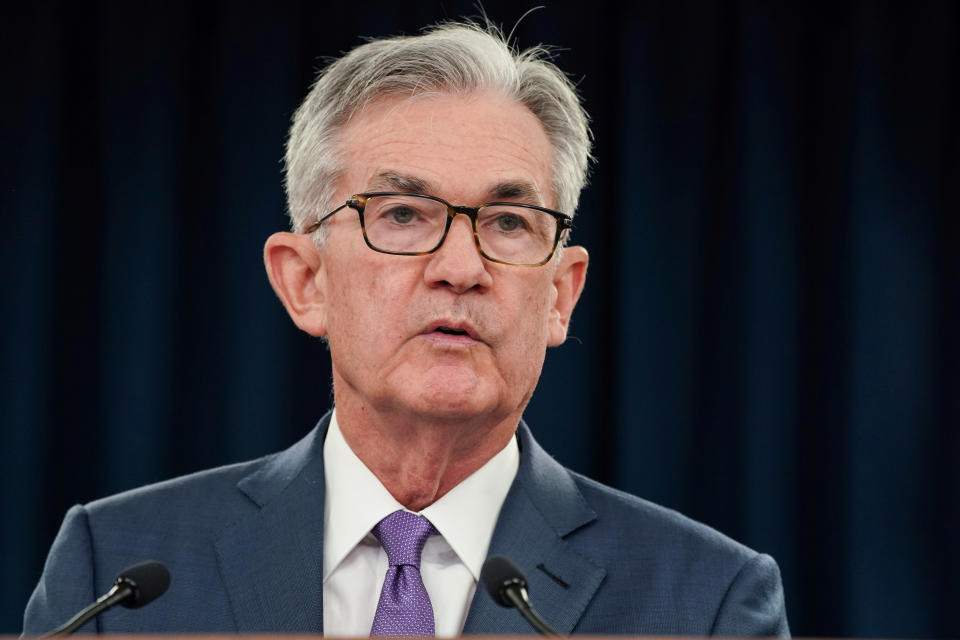

This week, Federal Reserve Chairman Jerome Powell noted the United States is “far behind other countries” and told reporters the central bank is “seriously considering” building a real-time payments system.

But Van Hollen and Sen. Elizabeth Warren (D-MA) are trying to force the Fed into action. The senators have introduced legislation, called the Payments Modernization Act, that would require the Fed to build its own real-time payments system. Van Hollen argues consumers are losing billions of dollars every year, because the United States does not have a faster payments system.

The bill aims to make sure more people have access to their money when they need it, essentially enabling consumers to immediately access money that goes to their bank accounts.

“This is especially true for people who are living paycheck to paycheck and they cash their paycheck and the check doesn't clear for a number of days. And in the process they're subject to late fees, overdraft fees if they attempt to access their accounts — or they’re driven for those few days into the hands of payday lenders,” Van Hollen said.

Powell told reporters the Fed has received “overwhelmingly favorable” comments about establishing a real-time payment system. Powell said the Fed has not made a decision about building a real-time payments system, but he expects a decision soon.

On Monday, Federal Reserve Governor Lael Brainard is set to give a speech on payments systems in Kansas City.

“The Fed needs to move from ‘considering’ to action because, you know, the more time goes by, the more the big banks will try to derail this effort,” said Van Hollen.

The private sector is already working on a real-time payments network, and Van Hollen and Warren argue if the Fed doesn’t act it could “result in a de facto monopoly of our payments system by the big banks.”

“Community banks are fearful of giving control of the payment systems to the big banks, because they worry about their access to the system. They appropriately worry about pricing discrimination, and they worry about the monopoly power of the big banks being used to discriminate against the smaller banks — and there are also issues of accountability,” said Van Hollen. “There are a whole host of reasons why this needs to be under the stewardship and control of the Federal Reserve.”

In a recent letter to senators, obtained by Politico, Powell said the private sector would face “significant challenges” in extending “equitable access” to thousands of banks across the country.

“By contrast, the Federal Reserve is uniquely placed to overcome the challenge of extending nationwide access to an infrastructure for faster payments system, due in large part to its existing nationwide payment infrastructure and established customer service relationships with more than 10,000 depository institutions (or their agents),” said Powell in the letter.

Powell said in the letter if the Fed moves forward, it would formally request public comment and gather input from the industry about finalizing the initial design and features of the service.

“There’s no excuse for further delay,” said Van Hollen.

Jessica Smith is a reporter for Yahoo Finance based in Washington, D.C. Follow her on Twitter at @JessicaASmith8.

Senator proposes 'worker dividend' of $1 for every $1 million spent on buybacks

Circle CEO: Attention on Facebook's Libra is 'double-edged sword' for crypto

House passes bill to stop coming 'tidal wave' of failing pensions

Amazon, Facebook each spent more than $4M lobbying DC last quarter

House votes to raise minimum wage to $15 an hour

Read the latest financial and business news from Yahoo Finance

Yahoo Lifestyle

Yahoo Lifestyle