Lyft app usage slows, data shows, ahead of the ride share company's earnings report

Lyft (LYFT) reports earnings after the market close Wednesday and while some analysts expect the ride share company to posts good results, new data about Lyft’s drivers is raising a red flag about the company’s future growth.

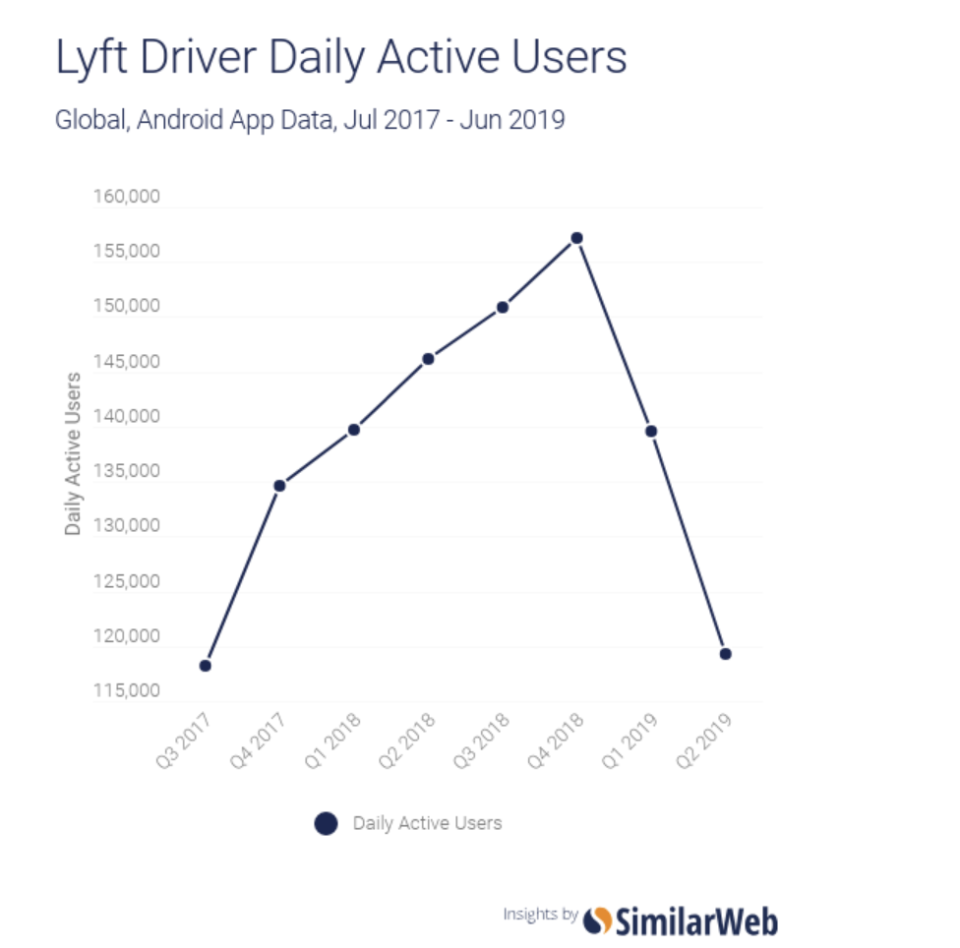

“A decline in DAU (daily active users) of drivers would imply there is less opportunity for work and therefore there may be less riders,” says Ed Lavery, investor specialist at SimilarWeb, which sells “alternative data” analytics to investors to help them gain insights before a company reports earnings.

Here’s what SimilarWeb’s latest data tells us about Lyft.

“The number of Lyft drivers using the app (on Android devices) on a daily basis in the U.S. decreased by 18% in Q2,” Lavery says, adding that it is a warning to investors that Lyft’s “growth is slowing down.”

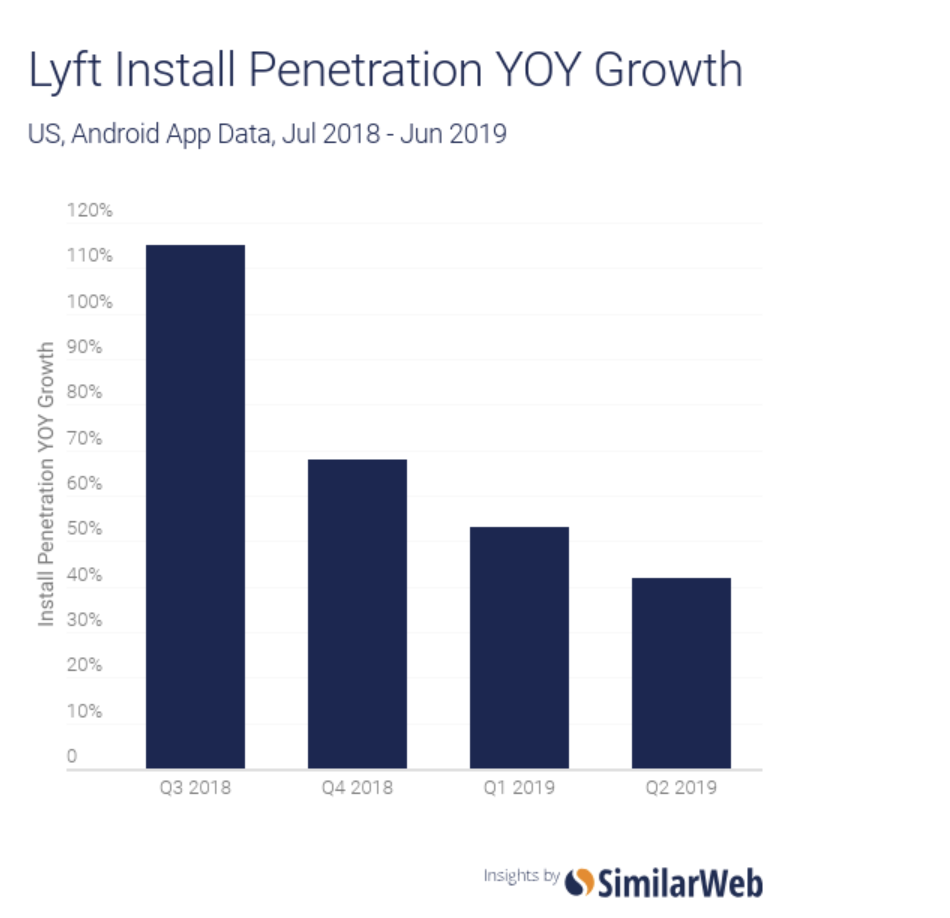

The new data revealing fewer drivers using the app daily may signal that the number of riders using Lyft is also slowing down, according to Lavery, adding that there is a correlation between the drop in driver daily active users and riders installing the Lyft app on their smartphones.

“I think the driver slowdown is a symptom but not the main data point here,” Lavery says. ”It validates what we are seeing with the riders.”

According to SimilarWeb’s report, more available drivers on the app leads to shorter wait time for customers. And shorter wait times are more attractive to riders, which keeps them coming back. So, overall the new data is bad news for Lyft.

But some analysts aren’t too concerned about Lyft’s DAUs. Tom White, senior research analyst at D.A. Davidson , says a decline in drivers would be worrisome, “But it runs counter to some of the data we’ve seen that suggests that Lyft’s share of rides in large urban centers specifically New York, continues to tick up.”

Adam Augusiak-Boro, senior research analyst at EquityZen, agrees with White adding that investors should pay closer attention to Lyft’s per user metrics. “It’s very possible that, while DAU numbers are dropping, Lyft’s remaining users are utilizing the platform more frequently, contributing more significantly to Lyft’s margin than newly acquired users.”

“The drop in DAU is not necessarily indicative of a material deterioration in the health of Lyft’s business,” says Augusiak-Boro.

Analysts are optimistic

Some analysts still have bullish projections for Lyft.

Cowen expects Lyft to report solid 2Q19 earnings, estimating revenue of $810 million and active riders of 21.3 million, up 38% year-over-year — largely driven by increased penetration of the service relative to the large TAM (total addressable market), the investment bank wrote in a recent note to investors.

Barclays Equity Research also estimates “rides are growing around 40% (to 205 million or thereabouts) in 2Q19, hence we are watching the EBIT per-ride closely for signs of improvement.”

Augusiak-Boro says the one question investors want answered is, “Whether the company can reach profitability at its current scale.”

Dan Ives, managing director of equity research at Wedbush Securities, doesn’t expect Lyft to post a profit for at least three years. Ives says Q2 is a key quarter for Lyft, “To prove to the street that they can increase user growth against the likes of Uber (UBER) and gain share while the pricing war remains an overhang.”

Adam Shapiro is co-anchor of Yahoo Finance On the Move.

Read the latest financial and business news from Yahoo Finance

Yahoo Lifestyle

Yahoo Lifestyle