Boston Fed President: No 'clear and compelling' case for this week's rate cut

Federal Reserve Bank of Boston President Eric Rosengren said Friday that he voted against the Fed’s decision to cut rates on Wednesday because he worried that easier policy could introduce more leverage in the financial system.

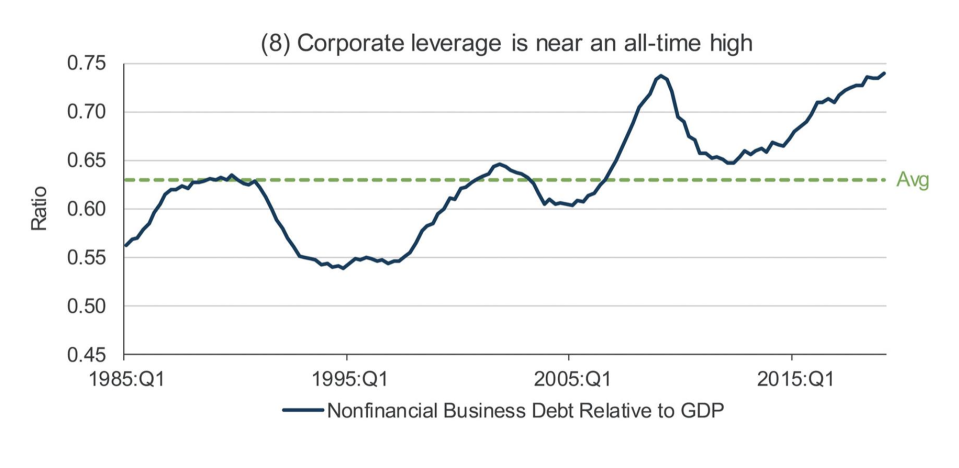

“With the unemployment rate near 50-year lows and inflation likely to rise toward the 2% target, and with financial stability concerns being somewhat elevated given near-record equity prices and corporate leverage, I do not see a clear and compelling case for additional monetary accommodation at this time,” Rosengren said in a statement released Friday.

Rosengren was one of two voting members of the Federal Open Market Committee to dissent on the decision to lower rates by 25 basis points on Wednesday, which was the first time rates were cut since the financial crisis. The other was Kansas City Fed President Esther George.

The Boston Fed chief hinted at concerns that the Fed’s rate cut could actually harm the U.S. economy by further boosting record-level stock prices and introducing more leverage into the financial system.

The S&P 500 hit eight new highs in July alone.

On leverage, Rosengren pointed to record levels of corporate debt, which has been fueled in recent years by historically low interest rates.

Fed Chairman Jerome Powell acknowledged some of these concerns in his press conference on Wednesday, saying that he does see “valuation pressures” but “not at a highly troubling level.” On corporate debt, Powell said it could be an “amplifier to a downturn” but described leverage in the overall financial system as “low.”

“Overall, staff’s view has been, and my view has been that if you look overall financial stability vulnerabilities are moderate,” Powell said.

Rosengren’s remarks on inflation also appear to contrast with Powell’s description of the U.S. economy during his press conference on Wednesday. While Powell said domestic inflation could rise to its 2% goal, he said the return to that level is at risk of being “further delayed.” Rosengren pointed to the trimmed mean measure of inflation in noting that inflation does not appear to be far from the Fed’s 2% target (the FOMC’s preferred measure of inflation is core personal consumption expenditures).

The Fed’s next policy-setting meeting will be on September 18.

George: Data ‘warranted no change’

Kansas City Fed President Esther George issued her own statement Friday afternoon clarifying that she dissented on the decision to lower the federal funds rate because “incoming data and the outlook for economic activity over the medium term warranted no change in the policy rate.”

George said she expected the moderation of economic growth in 2019. GDP grew by an impressive 3.1% in the first quarter of the year but slowed to 2.1% in the second quarter.

George added that with unemployment at record lows and “benign” inflation, she would have preferred keeping rates at the previous target range of 2.25% to 2.5%.

But George said she has an open mind with trade policy uncertainty and weaker global growth.

“Should incoming data point to a weakening economy, I would be prepared to adjust policy consistent with the Federal Reserve’s mandates for maximum sustainable employment and stable prices.”

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed faces questions on ‘data-dependence’ heading into possible rate cut

'Blew it!' Trump's Fed-bashing on Twitter escalates ahead of possible rate cut

Fed's jumbled messaging catches Trump's attention ahead of key policy-setting meeting

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Yahoo Lifestyle

Yahoo Lifestyle